Nevertheless, just going through the process of creating a financial plan for your new venture is extremely important - not only because potential investors demand it, but also for you, as an entrepreneur, to test if there really is a sustainable business behind your idea.

At the end of the day, more than the real value of the business, potential investors will base their decision on the vision of its founders and how they’re able to translate it into a profitable business model.

Investors do that by assessing the logic behind your assumptions, comparing the progression that is proposed with their business experience, and essentially testing your ability to create real value.

That’s what you charge for as a company - real value (in the perspective of your clients, that is) and hopefully enough to more than cover the costs of keeping your company running. However, not everything goes! Here are some tips to achieve a reasonable business plan for startups.

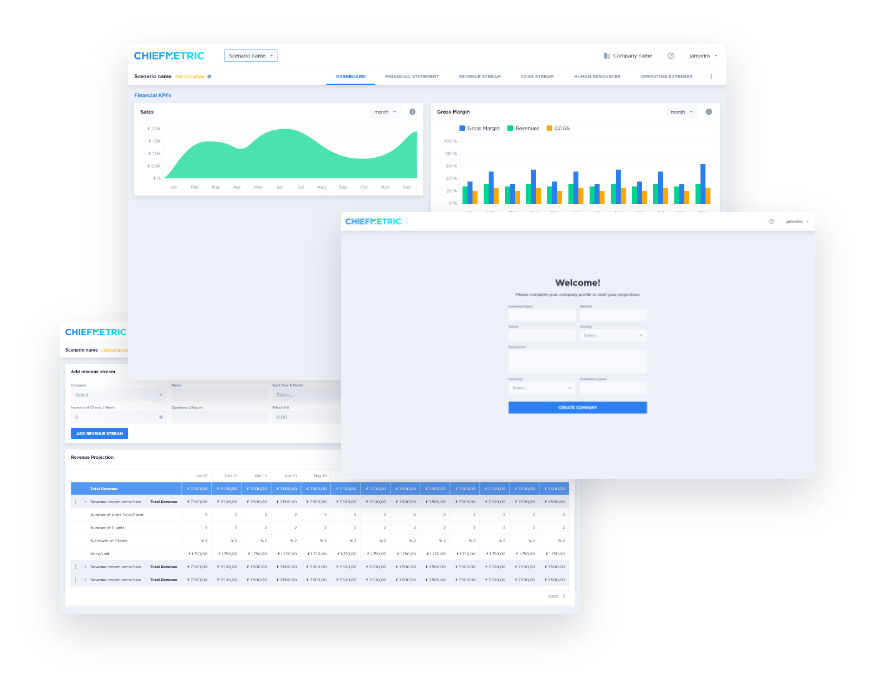

And remember that if you don't want to go through a spreadsheet mess, just 🔥 check our new financial modelling tool 🔥.

General Guidelines for Startup Financial Modeling

Guideline #1 - Financial projections have to be based on a rational business strategy

Some things really can’t happen on your projections, such as selling more than the size of your market, or targeting dozens of millions of sales on your first operating year.

That doesn’t mean it won’t happen - it would be an amazing achievement if it did - but in this overloaded startup ecosystem, the majority of investors have developed a cynical view on the way they evaluate potential investments, so try to be as credible as possible.

We recommend three-year financial projections to show your expectations on sales and expense evolution, as anything longer requires the most sophisticated of crystal balls.

Guideline #2 - Show aggressive sales projections on your financial plan

Ok, so the first point is all about being reasonable, and now we tell you to show aggressive business projections. Well, it’s one thing to be reasonable, and another to be conservative. If you look at startup success cases, you’ll get a better idea of what we’re talking about.

Doubling revenues year over year is not far from investors expectations, while a conservative 20% annual growth may be a motive for automatic discard, unless backed up by a roadmap that justifies a slower growth at first.

A slower initial growth may happen for many reasons, either by validation efforts, clinical trials, or something that your company really has to go through before starting to sell as fast as the amount of investment you’re asking requires. But that must be clear, and aggressive growth is always expected eventually along the way.

Guideline #3 - Aim for a company size that allows premium returns on investment

As a rule of thumb, some experts state companies should have between 20 million and 100 million euros of revenue after five years.

Some startup accelerators are registering a long-term Internal Return on Investment of 2-3X, while the time to realise value seems to be much lower - 12 to 18 months - in ecosystems with high appetite for risk, such as Silicon Valley.

While a lot depends on the stage investors are entering a company, the project return should be comparatively appealing enough to keep your business plan on the table.

Guideline #4 - Make sure the projected market share on your startup financial model is consistent with your value proposition

If your company offers disruptional value to its customers, it’s not unreasonable to target a 5% market share after three full operational years.

That being said, the extreme opposite is not good either, as it may be a sign of small opportunity.

Guideline #5 - Benchmark industry ratios and validate your startup financials

Unless your startup's innovation is extended to its financial model, there are some ratios you should have in line with the rest of companies operating in your same industry.

For example, if the industry shows a gross margin of 60%, while your startup’s financials are based on a lower margin backed by the promise of more work, this just won’t convince, as it is a clear sign of inexperience on the founder’s side.

Guideline #6 - Ask for funding considering some cash contingencies on your startup financial plan

After completing your financial projection, it’s advised to consider a 10 to 20% buffer on the projected investment needs, while never losing sight of the equity you’re willing to give up for that investment.

Now that we’ve highlighted some rules of the game, it’s time to go into some detail.

Ideal Financial Model Structure for Startups

Storyline is everything. The structure suggested below is just a common way of creating a Startup Financials’ MVM (Minimum Viable Model), so feel free to adapt this structure and to add or remove sections accordingly.

Also, take in mind that your startup financial model will change dozens of times, even if you’re dealing with just one potential investor, as it’s common to explore different scenarios, geographical markets, additional types of customers, among other things that will test the adaptability and opportunity behind your business idea.

Financial Model - Section 1/4: Revenue

Everything starts with sales. If the expectations are too high, the company may commit the mistake of over hiring. If the estimation is too low, there’s the risk of not being able to fulfil market expectations, which can result on permanent damage to the brand. Again, no one is expecting these estimations to be very close to reality, but these must be built on a foundation of well-sustained logic, maintaining the appeal of premium returns.

Some of the inputs you’ll have to define at this point include thinking of which revenue streams - or in other words, products and services - your company will have available, evolution of sales over time and pricing.

1.1. Revenue Streams: Products and Services

Although your company may have started with a great product idea, it’s always a good sign to be able to take advantage of your customer base and sell other products and services of added value to these customers - especially if the additional cost of production and/ or delivery is marginal regarding the main product line.

For example, if your startup is building an amazing software to help startups build their financial projections - as we are! - you may consider adding service options, such as customised advice on how to quantify the inputs of that financial model, while still offering a cheaper basic access to the platform.

1.2. Sales Evolution Over Time

This is one of the hardest parts of a financial model, but one of the easiest ways to get started is to base it on your existing traction.

Using data from historic performance, you should be able to have an idea of sales’ evolution and respective triggers, while making reasonable assumptions on customer growth, purchasing frequency over a period of time, your product roadmap, among other factors that may be relevant for your particular business.

However, not all startups have traction yet! If that’s the case for your startup, you can always use proxy companies and benchmark your way to a structured financial model.

1.3. Pricing

While the previous topics focused on revenue streams and volume of sales, this section can’t be completed without a price definition for each product/ service your company has available.

To get to a reasonable price, there’s several things you can do: consider what competition is charging for similar products or services, opt for a price that’s based on a reasonable margin for your industry taking into account the costs of production, or try to get a sense of the value that potential customers attribute to what you’ll sell them (by talking to them!).

Basing your pricing on the perceived customer value is also advised when the product or service your startup offers is particularly innovative - you'll likely not want to set a price of 19 euros per unit of Product A, when having that product will result on thousands of euros saved each of its consumers!

1.4. Other Revenue Estimation Guidelines

- Create different scenarios, considering pessimistic and optimistic views on each of the variables mentioned above.

- Remember to show interesting sales evolution without falling into unrealistic wishful thinking projections.

- Have a story supporting each main change on sales evolution (e.g. increase of clients at the double of the rate from previous month because there’s a specific fair you’ll be participating where you’ll meet more potential customers than usual).

- Reflect on the ending result - and remember the general rules mentioned in the beginning of this article.

Financial Model - Section 2/4: Cost of Goods Sold (COGS)

The costs of goods sold (COGS) are those costs directly associated to the production of your product/ service. These may include payment fees, raw materials or direct labor, to give some examples, but essentially everything you pay for to be able to sell. In other words, the cost of revenue.

Subtracting COGS from Revenue, you’ll get your company's Gross Margin. This margin may vary over time, increasing as production efficiencies are achieved, or decreasing as new revenue streams are added for the sake of achieving a bigger available market.

Financial Model - Section 3/4: Human Resources

Which roles are required to create the first version of your product or service? What about sales? Are there any positions which depend on the sales of customers volume (e.g. customer care)? If so, what is the limit one member of that team can deal with per day? What about positions that are not linked to sales evolution but are critical to ensure the company’s vision (e.g. Innovation Manager)?

Usually, the headcount of some teams will evolve according to sales, such as commercial, marketing, customer support, production, etc.

However, some not-so-common positions may be required from day one, such as a Chief Technology Officer if that function is critical to deliver your value proposition, or a Chief Culture Officer, if part of your startup’s fundamental innovation relies on a unique set of values and behaviors that define its organizational environment.

Don’t forget to include taxes, bonuses and benefits in addition to the base salary of each job position, as well as salary increases. People evolve - with or without you!

Financial Model - Section 4/4: Operating Expenses

Here is where expenses such as marketing, legal consultancy and external providers are included, as well as office rent and supplies. Consider possible adaptations of these expenses along the way, such as the ones mentioned below.

- The Customer Acquisition Cost (CAC) may vary by target segment or geography, while at the same time it can also be optimized as the marketing team fine-tunes campaigns regarding budget by channel, message, retention flows, etc.

- External providers may jump in only on specific stages of your company lifecycle. For example, you may have additional tech support while you can’t ensure internal development before closing a certain round of investment, and delay these hirings until you do so.

- Marketing expenses can be easily set as a benchmark percentage of sales, usually varying between 5% and 20%, but these costs may be relatively higher in the beginning, as the company is only launching its brand.

- Don’t forget office rent should evolve along with new hires, or consider going full remote like Twitter - whatever you decide, state it clearly on the business plan, and reflect those choices on the financial model of your startup.

Presenting a Startup Financial Model to Potential Investors

Up until now, we have been talking about a possible structure for your startup’s financial inputs. But what are the outputs of this planning process, and what documents will be expected by potential investors?

Startup Essential Document #1: Business Plan

A business plan is much more than its financial projections, but both should be completely aligned to ensure reasonability. The Business Plan is a document where you state the problem your startup is solving, the size of the opportunity, how you’ll do to reach that market, how you’ll make money, and essentially, the how and why of your financial model. Although every startup has its own storyline, here is a possible structure for a business plan.

I. Executive Summary

In one page maximum, you should detail the company’s main highlights so far, as well as the investment opportunity. Consider including one paragraph for each of the following topics.

- Problem & Solution

- Validation

- What’s been done so far

- Financing Needs and Goal

Extra tip: write it at the end, as the overall strategy will likely end up changing several times. Save your time and inspiration for the closing scene!

II. Problem and Solution

First, start with the real purpose of your startup.

- What problem are you solving?

- How big is it? Try to quantify the pain you’re tackling.

- What are the current solutions that somehow solve that problem?

Ok, so now that we know that there’s a problem worth solving, explain us how you’ll actually do it.

- What’s your startup value proposition? Confront your solution with the problem - there is a reason for these two topics to be on the same section!

- How unique is your solution, and what is different about it?

- And so importantly: what’s your vision?

For example, pools are boring… so thank god for floating flamingos? 🤔

We do hope your startup is solving a bigger problem than that! 😅

III. Product/ Technology/ IP

How was your solution built? What makes it different/ innovative? Is it suitable for Intellectual Property Protection?

- Technology Description

- Current Stage (e.g. MVP with certain features)

- Product Roadmap

Remember to leave the details for the Exhibits.

IV. Business Model and Go-to-Market Strategy

How will you make money? What are the critical activities of your business? How will you acquire customers?

- Revenue Model

- Validation

- Potential Clients - description and segment quantification

- Metrics (e.g. acquisition funnel conversion rates)

- Expansion Plan

V. Market

What is the market dimension? Where will you start and why? What is your target and expansion strategy?

- Total Available Market (TAM)

- Serviceable Available Market (SAM)

- Serviceable Obtainable Market (SOM)

- Market Growth

VI. Competition

Who are your competitors? What makes you different? Can you quantify those differences?

- Current Competitors

- Comparison with our solution

- Barriers to Replicate

VII. Risks

What could block your market entrance? Do you have any legal barriers? How do you overcome those risks?

- Identified Risks (e.g.: adoption risk; regulation)

- Critical Success Factors

- Risk Mitigation

VIII. Team

Who is going to execute this plan? Why are they the right people for the task?

Time to define the Chief Something Officers of your team!

IX. Funding Needs (and Exit Strategy)

How much investment is needed to make this plan a reality? (What could be some potential exit strategies?)

- Funds’ Applications - leave the detailed Profit & Loss Statement for the Exhibits

- Previous Funding

- Expected Exits (optional) - disclaimer: some investors hate seeing this, as it may show you’re not in it for long term, others love it, as it shows a possible way of return. Try to see how other companies on a certain portfolio are doing and adapt your business plan accordingly before sending it to each investor.

X. Exhibits

Leave all the details for this part!

- Market Size Details and Characterization

- Product Roadmap

- Competitive Analysis

- Founders Team Short Résumé

- Financial Statements

Startup Essential Document #2: Profit & Loss Statement (aka Income Statement)

Although you will likely have to send a cash flow statement and the balance sheet that complete your set of financial statements, most of the discussion will be around the Income Statement, also known as the Profit & Loss Statement.

Again, it all starts with reasonable inputs, hopefully somehow validated with data and feedback from real customers.

After having gathered this data, you’ll be able to structure it in order to create your Profit & Loss Statement.

If you have no idea how to do that, we can help! That’s why we’re here.

Just contact us or choose one of the plans we have available to access the most easy to use financial projection software in the digital world.

Startup Essential Document #3: Pitch Deck

Any startup knows a pitch deck is a basic requirement to have - not only for potential investors, but even clients, partners or journalists are so used to asking for this piece of information when it comes to startups, that is has just become an essential.

There is an art to it, of course, but we’ll talk more about it on another post.

Startup Essential Document #4: One Pager

The One Pager is basically a written pitch of your startup.

Remember that investors receive a huge amount of investment proposals at the time, so they’ll not be able to read every business plan out there.

As the name states, this one page document should present your startup in a compelling way - including visually -, while acting as a bait for potential investors’ interest.

If you have to choose, this should be the document you send to colder leads - for example, after a startup event, where these investors have likely received at least a dozen other documents with alternative startup investment opportunities.

Don’t know how to stand out doing this? Let us know and we’ll send you a validated template for free!